AI that pays off – how to calculate your ROI

AI that pays

off – how to calculate

your ROI

How to successfully implement AI

in your business - Part 3

Who doesn't love the initial euphoria of energetic brainstorming sessions? Everything seems to fall into place all by itself, and anything seems possible. Particularly when it comes to artificial intelligence, the levels of enthusiasm seem to increase proportionally with the management’s ambitions of scaling up the business. Suddenly, streamlining and simplifying all processes seems feasible instead of being an unattainable dream, and the creative possibilities seem limitless… Until, inevitably, the crushing weight of reality sets in. It’s best for this to happen sooner rather than later. But how does one find this point? Ideally already during the exploration phase?

The best way to answer this is with a simple question: Will this investment actually pay off? Answering this question quickly separates the wheat from the chaff, or, in this case, helps differentiate between a pipe dream and a professional approach leading to a sustainable, effective project. You need to be able to identify where investing in AI will add real value instead of simply burning cash. In order to not leave you all alone with the task of calculating the profitability of your AI project, in this article I will introduce you to the tools you need to answer these questions by yourself.

In my previous newsletters, I already talked about four important perspectives from which to view the introduction of AI in companies: the strategic and technical perspective, the availability of data, and the economic efficiency. This edition will focus on the financial aspects. Read on to find out how to correctly calculate the financing for your AI project in advance, and what you need to bear in mind.

The implementation of artificial intelligence is not an end in itself. It needs to bring tangible benefits, create added value, and also be economically worthwhile. Calculating a solid business case for your AI project therefore is a crucial prerequisite for its successful implementation. The following questions will help you identify the relevant figures for your AI business case:

- How can profits be generated by your AI application?

- What costs are involved?

- How do I realistically calculate the ROI?

Once these questions have been sufficiently answered, you will have a concrete basis for your investment decision.

One thing should be made clear at the outset: you will not be able to determine all of these factors with complete certainty in advance.

However, you will be able to clearly determine whether an investment will pay off nevertheless, and under which conditions. By the end of this article, you will find out how. But first things first.

1. Three ways generate profits

with AI

1. Three ways

generate profits

with AI

In order to make profits, you need to invest. That’s business 101. But the added value gained from your investments doesn’t necessarily need to be monetary. An improved reputation, better health and satisfaction of customers or employees, strategic advantages over the competition, or a reduction in CO2 emissions can all be part of a positive return on investment for your company. All of these factors will ultimately be reflected in your financials.Therefore, it is crucial to determine which factors and time periods you use in your calculations. To accurately calculate ROI for an AI investment, you should therefore first consider how your AI will generate profits for you: will it save costs, avoid or reduce other expenditures, or increase turnover?

Cost savings

Your AI will save costs if it reduces current expenditure on employees, service providers or inefficient processes. Take a chatbot as an example: Some products require a high level of customer support, which is often handled by external call centers. A high demand for support leads to high personnel costs, which results in high external costs. Now imagine an AI-powered chatbot as a solution, which is integrated directly into your product. It answers frequently asked questions automatically using "information extraction" and "question answering" based on your own data. Customers are given immediate support and the external call center is less busy. As a result, you save costs.

What is often forgotten: The decisive factor for a correctly calculated ROI is that the savings measures are actually implemented properly. Otherwise, the only effect they have is generating more costs. Let's assume that the relevant call center is not operated externally, but internally. The staff relieved by the chatbot would then actually have to be made redundant, which is not always possible or desirable due to collective labor agreements and labor protection laws. To accurately calculate the ROI here, make sure that you factor in any restructuring measures (retraining, redundancy payments, etc.).

Avoiding or reducing other expenditures

Your AI can also generate profits by preventing or reducing larger investments in other areas, for example in cybersecurity or by actively counteracting the skilled labor shortage.

Take accounting software as an example: You know that your HR department is responsible for payroll accounting for more than 10,000 employees. However, due to sick leave, departures and a lack of new hires, you don't have the human resources to do this. With the help of AI, you want to intelligently automate time-consuming and recurring processes, or avoid the costs of potentially unsuccessful recruiting or of outsourcing payroll accounting.

To accurately calculate ROI here, it must be calculated in relation to the alternative investments that would be made otherwise, which must therefore be included in the calculation.

Increasing turnover

By speeding up production processes, increasing production capacities, or by becoming a new product in itself, your AI can directly generate new revenues. Take an SaaS model as an example: Imagine you have trained an AI software based on the practical experience of your employees and internal company data and knowledge. This tool can also add great added value to other market participants. Thus, you release this software on the market as an SaaS tool and generate millions in completely new revenue, without needing any (new) staff.

2. What is the cost of AI?

So much for the possible and calculable profits. Now, it is time to identify and make a realistic assessment of all the relevant indicators for the initiation and operating costs, plus follow-up costs for your AI model. To do this, you need a comprehensive view of all the required technologies, data, project structures and personnel resources. And those are just the big points! The following cost factors must be considered when developing and using artificial intelligence:

Personnel costs

To successfully implement AI projects, you need one thing above all: knowledge. First, you must build up this knowledge (within your company), then maintain it, and finally continue developing it. This does not happen on its own. It requires internal or external experts in AI strategy, data science, data engineering, data analysis and IT architecture. Even if you have already built up an IT/data team, you will always need to continue adding further external experts and services. The challenge is that these external and internal costs vary over the calculated timeframe. It is very important to closely look at these costs.

Personnel costs will therefore always be an important expense. Therefore you should guarantee that these costs are invested in the best possible way: in good employees, good advice, and good services.

Data

Data - as you’ll remember from my last article - is the raw material you need to fuel your AI systems. There is no AI without data. Data must be collected, analyzed, maintained, merged, synthesized or purchased. All of this incurs costs. The more you know about data and its availability, the easier it is to calculate these costs. However, not only the quantity but also the quality of your data is crucial. The task of your data governance is to ensure this. This is an ongoing expense that is always worthwhile. After all, an AI is only as good as the data it has been trained with.

Research & Development

This is the cool part. It conjured up an image of the mad scientist, working out of a cluttered garage, powered only by energy drinks. But the harsh reality, also here, is that research (no matter how cool and nerdy) costs a lot of money. From brainstorming for a neatly designed AI application, to proofs of concept, developing initial prototypes and MVPs, through to the final evaluation. These investments cannot be calculated with complete accuracy, but they are nevertheless a cost item that you need to take into account. There is usually a fixed budget framework. However, the results delivered (and the associated value to the company) cannot be guaranteed. Much depends on the available data and the expertise of your team.

Initial Development

Once the fun part is done, it's time to get down to business: Setting up an IT infrastructure for your AI application. This includes software development, the design and development of interfaces to existing systems, and the automated AI model training, MLOps (Machine Learning Operations). Only then, you will have an AI that can be used in the long term and is seamlessly integrated into your infrastructure. But you still haven’t reached the end of the road. The following is still waiting for you:

Ongoing costs

An AI model is never really complete. As the name suggests, the system is “intelligent”, it "learns" and grows. And it does so through regular retraining with new data sets. These data sets must be analyzed, processed and integrated. Plus, time does not stand still. In addition to being continuously operated, the system/software must always be developed further and updated accordingly. There are also costs for cloud services and potential license fees for the software used. Depending on the architecture, you will therefore be faced with different types of expenses. Only if you have the necessary expertise about the technologies used, will you be able to realistically calculate these costs in advance.

3. ROI – How to properly calculate it

3. ROI – How to

properly calculate it

As you can see, everything is connected to everything else. This makes it all the more important to be as clear as possible about all these points in advance. Only then will you be able to judge whether implementing an AI application is economically viable for your company. But even if all these figures are available, a simple cost and earnings calculation will hardly give you a realistic profit forecast. Technical and economic developments are too dynamic. So how can you make a reliable ROI calculation?

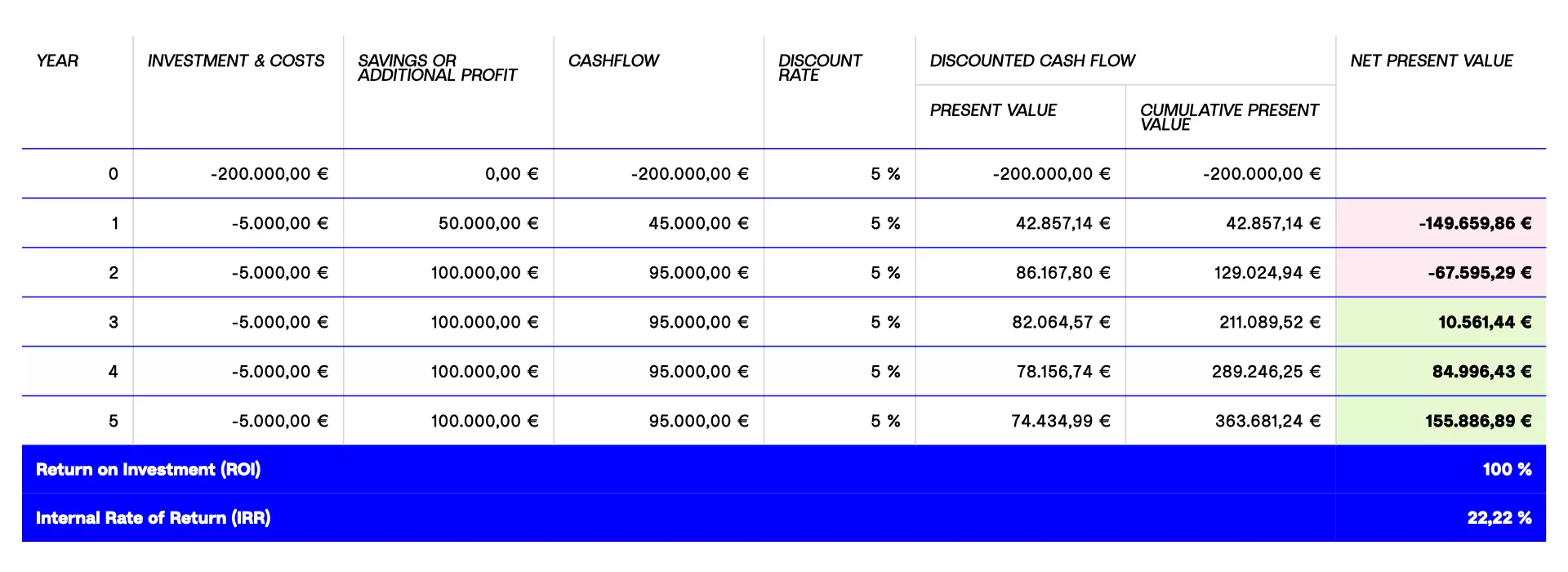

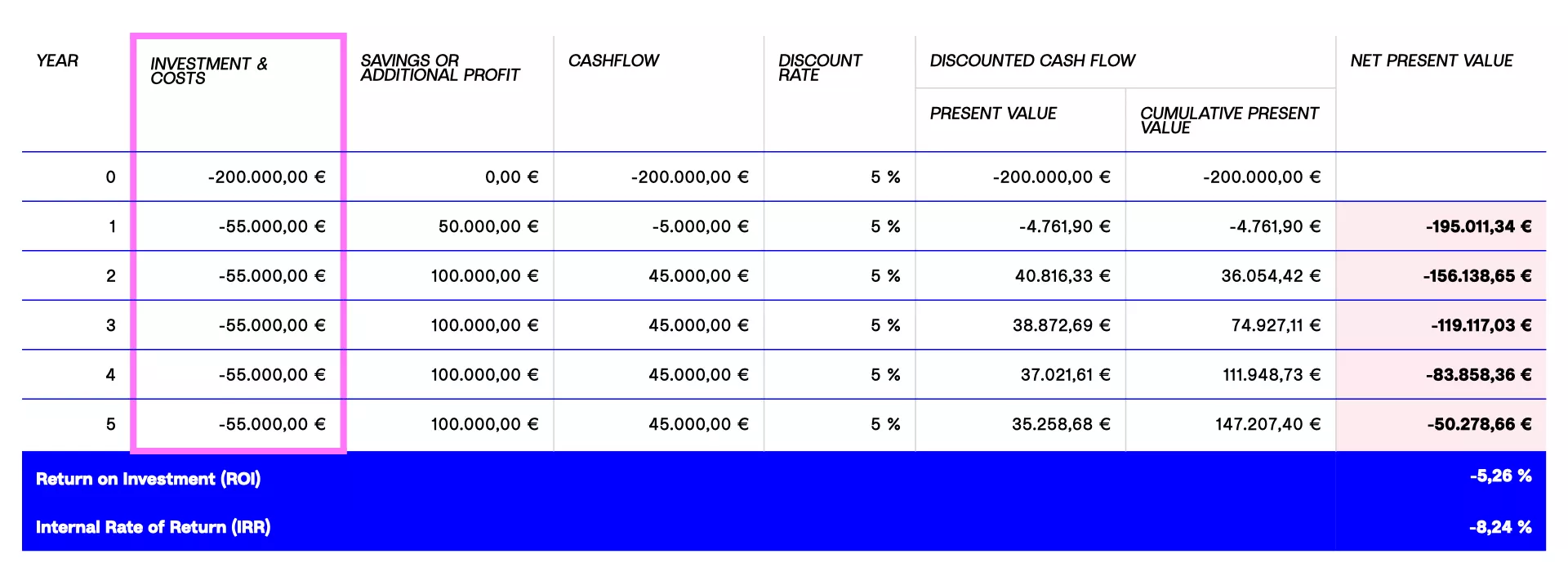

At PLAN D, we use discounted cash flow (DCF) analysis, a financial method for valuing investments that discounts future cash flows to their present value. In simple terms, the method calculates what an amount of money that I will receive in the future is worth today. AI investments are valued using return on investment (ROI) and the internal rate of return (IRR). This analysis can be particularly helpful because AI projects often require upfront investments that only offer significant returns in the long term.

Practical examples

Let’s come back to the aforementioned example about the customer service chatbot. Let’s assume that the initial development and implementation costs come up to 200.000 Euros. The chatbot is expected to save 100,000 euros per year in support costs. These savings can be realized directly, by reducing the capacity of the external call center. However, in the first year, the implementation of the chatbot is only gradually ramped up, so the savings are only 50,000 euros. Assuming a discount rate of 5 %, we therefore operate with the following base values:

- Initial costs: -200.000 Euro

- Ongoing costs: -5000 Euro

- Yearly savings: 50.000 Euro (year 1), 100.000 Euro (year 2-5)

- Discount rate: 5%

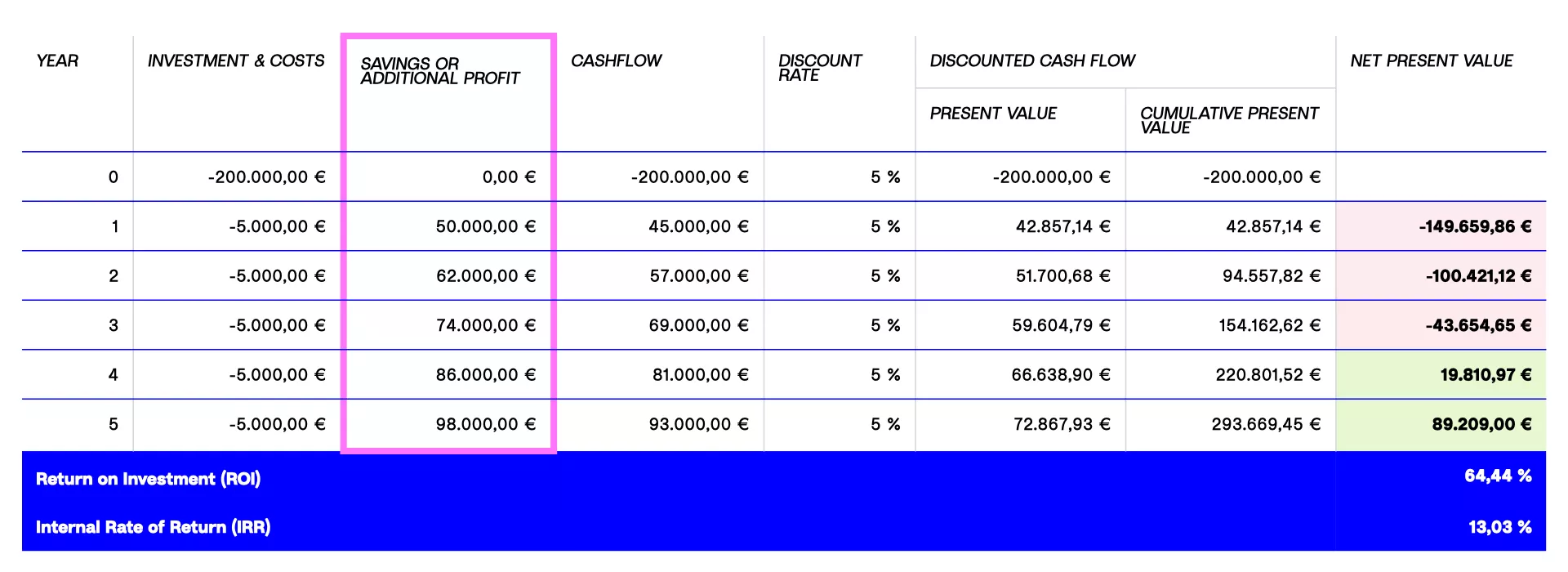

Let's now assume that the company initially still has (too) little training data, but hopes that the chatbot will improve over time through user feedback and a growing data repository. The savings are achieved more slowly, but steadily. And bingo: at the end of the five years, a positive ROI / IRR is generated, albeit over a longer period of time.

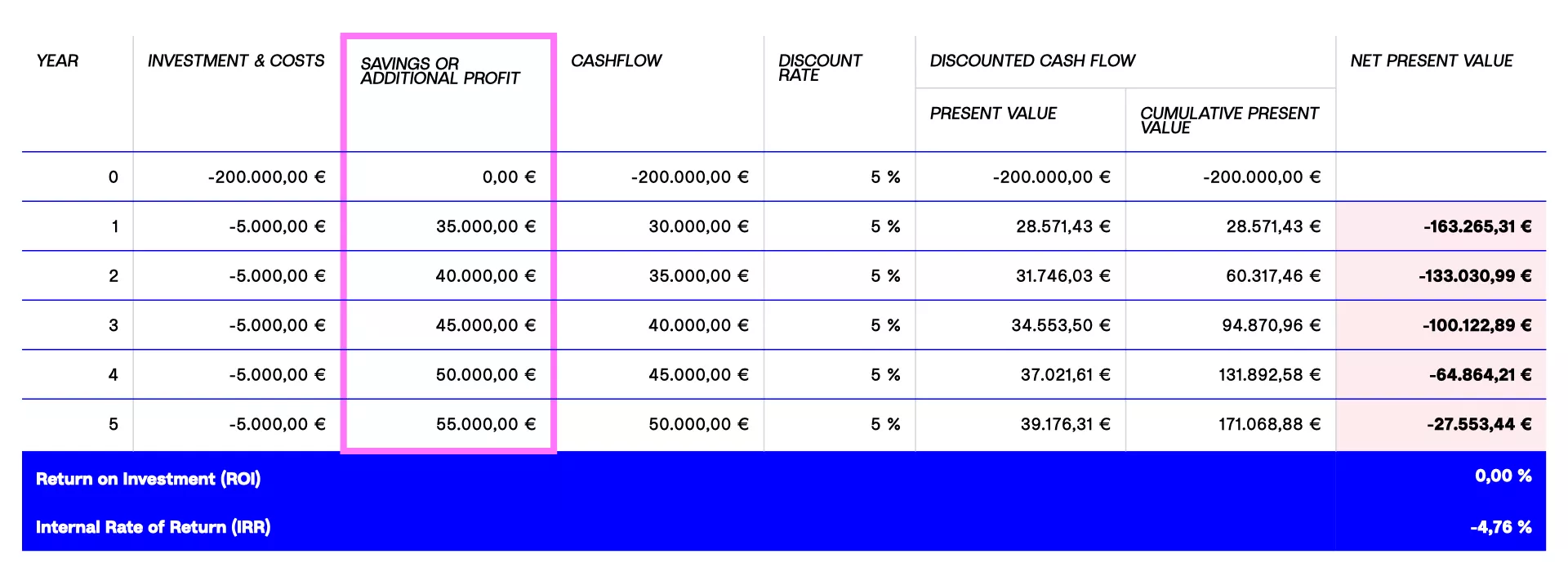

But what happens if the necessary data quality is not achieved? Even if the AI model itself continues to improve, poor data leads to poor results. If the performance does not develop as expected and the call center must still be used, savings do not increase quickly enough, the IRR after 5 years is negative and the ROI is 0.

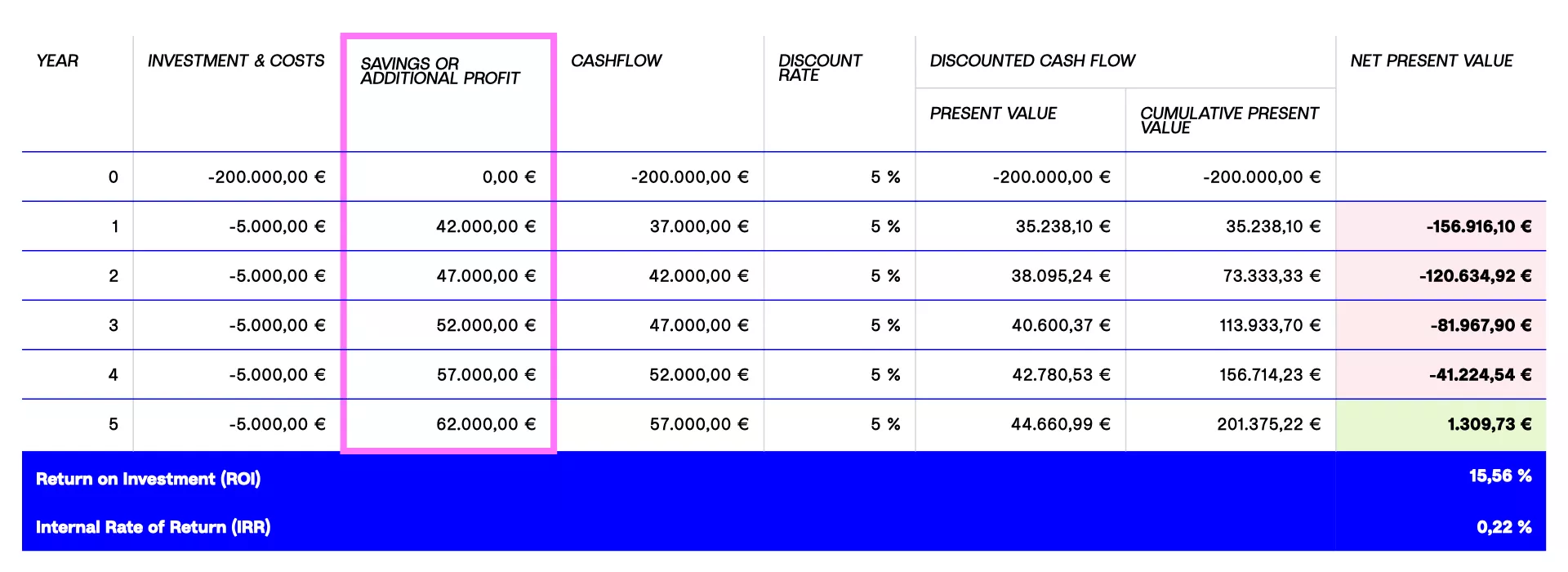

Let's assume that new data and user feedback help the chatbot with its performance. After 5 years, it can just about achieve a positive ROI / IRR. But such a long amortization period ignores the life cycle of the technology. Artificial intelligence is a rapidly developing field. A technology that is state of the art today may be outdated in a few years, and thus will need to be revised. It therefore makes sense to include the life cycle of the technology in the profitability analysis. Because even if the balance sheet is positive at the end of the period, new investments will have to be made again in the sixth year.

Final example: What if it's not the savings that change, but the costs? Consider the case of the internal call center mentioned above. The chatbot delivers annual savings of 70,000 euros, but the employees have to be retrained, transferred to other departments or made redundant with severance payments. A further 250,000 euros in restructuring costs are incurred over the calculated period. The result: the ROI and IRR are negative.

4. Investitionen, but do it safely

As I said, not everything is predictable. But when you take into account a broad basis of factors for a careful ROI calculation, you are preparing the best possible ground for your AI investment. Because what would be the alternative? Not investing in AI at all? Let's play this out: We are currently undergoing enormous change. The use of AI is leading to enormous upheaval and is changing the competitive landscape in almost all sectors. The EU is working on a new AI regulation, a unique set of rules for regulating artificial intelligence in its entire form and content. This is all happening now. So what will happen in the long term if we don't invest in AI? If we wait until everything is 100% predictable, it will probably be too late - the competition will be too far ahead. I am convinced that paying the price for that scenario would be much too high to afford. It would not be a positive, continuous forecast - it would simply lead to complete failure.

Once again, the big players in the market seem to hold all the cards in their hands. The largest companies have sufficient financial resources to fund AI investments directly from their cash flow. Not all of them can do this, of course. But there are other solutions.

We are currently witnessing a clear trend towards cooperatives: small companies with similar interests or business models are joining forces to form strategic partnerships or associations, in order to jointly manage the initially high investments. These alliances make it possible to share the costs and the associated risk. Co-operative structures, also financed by external funds, reduce the financial and technological hurdles that AI often represents. And that's a good thing.

Conclusion

Secure your investment in advance in the best possible way, by conducting a comprehensive ROI calculation which factors in the technological and strategic and personnel aspects. But don't be too hard on yourself. After all, you should invest in any case. Just ensure that you are technically savvy and fully informed.

Speaking of informed: Have you heard of the EU AI Act? The world's first legal framework for AI regulations is currently being negotiated at EU level and will come into force sooner or later. However, many people are still unsure about what the EU's AI regulation will actually mean for companies. One thing is certain: many AI systems need to be analyzed and revised in order to meet the legal requirements. The next issue of this newsletter will focus on how this can be achieved.